What are the annual earnings for a full-time minimum wage worker?

Minimum wage basic calculations and its impact on poverty

Since it was first instituted in 1938, the federal minimum wage has established a floor for wages. While not every worker is eligible, it provides a minimum of earnings for the lowest-paid workers.

What are full-time annual earnings at the current minimum wage?

The annual earnings for a full-time minimum-wage worker is $15,080 at the current federal minimum wage of $7.25. Full-time work means working 2,080 hours each year, which is 40 hours each week. However, many states have their own minimum wages, including many that are currently higher than the federal rate.

Minimum wages from state to state vary widely, from those with minimums that default to the federal rate to states with minimums that are higher. As of 2025, many states have minimum wages significantly above $7.25—examples include California (about $16.50), Washington (about $16.66), and New York (up to $17.95 in some localities).

Some states with minimums higher than the federal wage—such as New Jersey, Arizona and Washington—have also chosen to adjust their minimum wage annually for inflation or according to formulas tied to cost-of-living measures. Some municipalities, including Washington D.C., currently have a minimum wage for some employees that is even higher than minimums in any state.

How much is the federal minimum wage really worth?

Despite these recent increases in state minimum wages, the federal minimum wage has not increased since 2009 and remains at $7.25 per hour. Adjusting the real value for inflation, the real (inflation-adjusted) value of the federal minimum wage was much higher historically. Its real value peaked in 1968, when the nominal minimum of $1.60 was worth significantly more in today’s dollars than today’s $7.25.

Will a minimum wage job keep workers out of poverty?

Whether full-time work at minimum wage keeps a worker out of poverty depends on their family size and whether others in the household work. Someone who works full time for minimum wage and lives alone will earn below their poverty threshold in 2025. For single parents who work minimum wage, however, staying above poverty can be particularly challenging, even with full-time work.

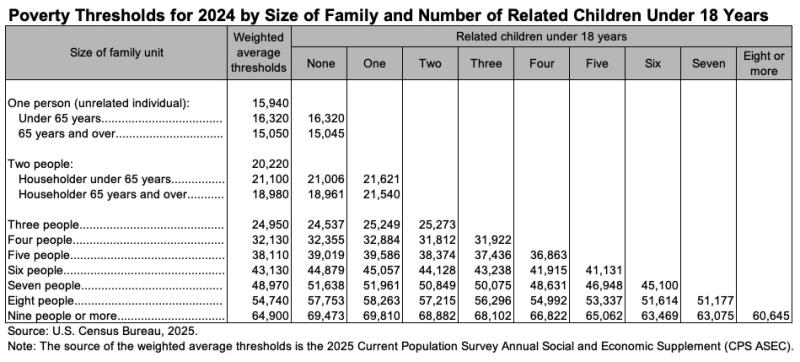

Poverty is determined by the U.S. Census Bureau’s poverty thresholds. These thresholds, updated annually, determine how much income a household requires to meet basic needs, such as food and shelter.

In 2025, a full-time minimum-wage worker earns $15,080 annually. The 2025 federal poverty guideline for a one-person household is $15,650, meaning a single worker earns 96.4 percent of the poverty threshold. For a two-person household, the poverty guideline is $21,150, and a single full-time minimum-wage worker earns 71.3 percent of that amount. For a single parent with one child (a two-person household), earnings at minimum wage fall below the poverty line.

For a three-person household, with a 2025 poverty guideline of $26,650, a full-time minimum-wage income covers only 56.6 percent of required income. For a four-person household, the poverty guideline is $32,150, and a minimum-wage worker earns just 46.9 percent of that level.

This means that in order to have earnings above their poverty threshold, a single parent with one child, for example, would have to earn at least $12.82 per hour working full-time in 2025. At the current federal minimum wage of $7.25, this single parent would have to work far more than 40 hours each week to exceed their poverty guideline.

The larger the family, the more hours of work are required to stay above poverty with a single minimum-wage income. A single parent working at the current minimum wage with two children would have to work very substantially more than a standard full-time schedule to keep the household above poverty.

Do workers at the minimum wage still need government assistance?

With a minimum wage income, even working full time, many workers will qualify for most federal safety net programs in the United States. Eligibility guidelines for government assistance are based on the Census Bureau thresholds, but are developed and updated annually by the U.S. Department of Health and Human Services. Those with incomes below a certain percentage of their poverty guideline will qualify.

Federal assistance programs all have eligibility requirements that are in part based on the proportion of household income to the federal poverty guideline. For example, the SNAP nutritional assistance program is available to those with a gross household income of up to about 130 percent of their federal poverty guideline.

In 2025, the federal poverty guideline for a family of three is $26,650, meaning the SNAP gross income limit for this household is $34,645 annually (130 percent of poverty). A full-time worker supporting this household alone, earning $15,080, makes only 43.5 percent of the SNAP income limit and would therefore qualify for benefits. To exceed the SNAP eligibility ceiling for a family of three, this worker would need to earn at least $16.66 per hour working 40 hours each week—or would have to work more than 91 hours per week at the current $7.25 minimum wage before the household loses eligibility for benefits.

These patterns hold for other household sizes as well. Because minimum-wage earnings fall well below poverty thresholds in households of two or more people, most minimum-wage workers supporting dependents remain eligible for a range of federal assistance programs, even when working full time.

Updated 12/11/25

For more information:

U.S. Census Bureau. Poverty in the United States: 2024 (latest official poverty estimates)

U.S. Department of Health and Human Services. 2025 Poverty Guidelines

U.S. Department of Agriculture. SNAP FY2025 Income Eligibility Standards