Expanded Child Tax Credit Payments Associated with Better Health and Greater Food Security

By Jordan M. Rook, Cecile L. Yama, Adam B. Schickedanz, UCLA; Alec M. Feuerbach, SUNY Downstate University Hospital; Steven L. Lee, University of Washington; and Lauren E. Wisk, UCLA

The 2021 Expanded Child Tax Credit (ECTC) provided families with children monthly payments from July 2021 to December 2021. In a recent study, we explored the extent to which these payments were associated which changes in adult overall health or household food security. We found that eligibility for ECTC payments was associated with improvements in both. Specifically, we found that ECTC-eligible adults experienced 3.0 percentage-point greater increase in the likelihood of excellent/very good health, and a 1.9 percentage-point greater increase in the probability of food security, than adults who were ECTC-ineligible. Our results suggest that cash-transfer programs are effective tools in improving adult health and household nutrition.

Key Facts

- In response to the COVID-19 pandemic, the Expanded Child Tax Credit (ECTC) provided eligible families with children unrestricted, fully refundable monthly payments between July and December 2021.

- ECTC eligibility was associated with improved adult overall health and household food security.

- Cash-transfer programs like the ECTC should be considered as a potentially effective method to improve population health.

Background

Poverty leads to reduced longevity and poorer health and development.[1] To address this, many countries use unconditional monthly cash transfer programs for families with children, with associated improvements in health outcomes.[2] In contrast, the United States has historically favored smaller annual tax rebates such as the Child Tax Credit for working families.[3,4]

In response to the COVID-19 pandemic, the American Rescue Plan of 2021 made several changes to the Child Tax Credit, including increasing the annual value of the credit to $3,600 for each child aged five and under and $3,000 for each child aged six to 17.[5] Notably, half of the total value was dispensed in monthly payments from July 15 to December 31 of 2021. These monthly payments temporarily reduced rates of poverty in households with children by 40%.[6] Unlike prior iterations of the Child Tax Credit, these payments were fully refundable, meaning that all low-income households were eligible to receive the full value of the credit as a direct deposit or check.[7] In our study, we set out to explore what impact these payments had on the health and food security of the families who received them.[8]

Exploring the Effects of the ECTC

We used National Health Interview Survey (NHIS) responses from January 1st 2019 to December 31st 2021. The NHIS is an annual, nationally representative cross-sectional household survey in which one adult is randomly interviewed per household and surveyed on health, health care access, and sociodemographic characteristics. Our study sample included 39,479 adult respondents. We included all households with a sample adult younger than 65 years of age and with a household income below the threshold for full eligibility for the ECTC. We defined households with children as ECTC-eligible, and households without children as ECTC-ineligible. We evaluated self-reported adult overall health and household food security based on answers given by survey participants to questions related to these outcomes. We then used linear probability models with ‘difference-in-differences’ estimators to evaluate changes in overall health and food security for ECTC-eligible households compared to ECTC-ineligible households before and after the initiation of monthly payments in July 2021.

ECTC Eligibility Associated with Better Health and Greater Food Security

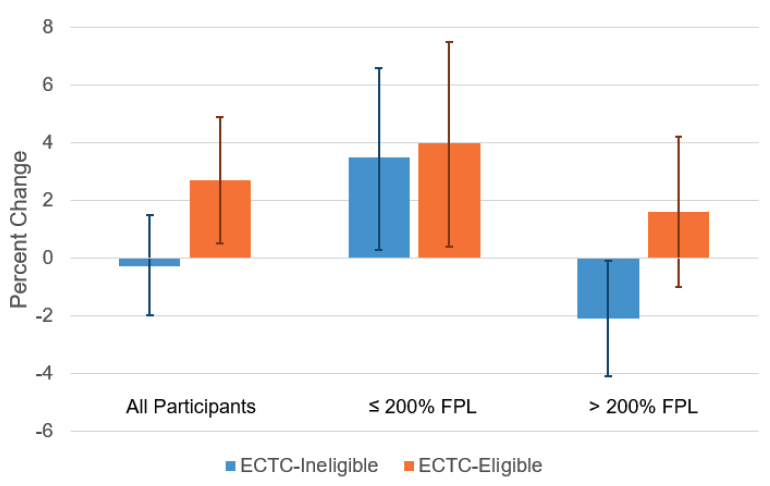

In terms of overall health, we found that, following disbursement of monthly payments, the frequency of ECTC-eligible adults reporting excellent or very good health increased from 60.1 percent to 63.1 percent. This was a 3.7 percentage-point (pp) greater unadjusted increase than that experienced by ECTC-ineligible adults. In our adjusted ‘difference-in-differences’ analyses, ECTC eligibility was associated with a 3.0 percentage-point increase in excellent and very good health.

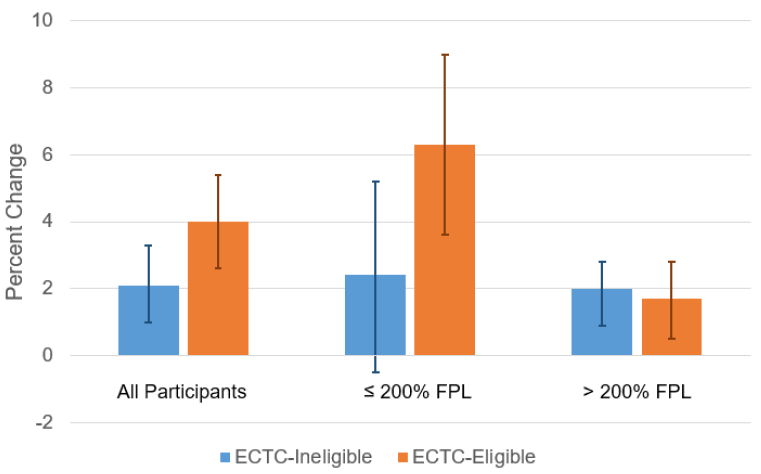

In terms of food security, we found that, following disbursement of monthly payments, ECTC-eligible households reported an increase in food security from 87.8 percent to 91.4 percent, a 1.7 percentage-point greater unadjusted increase than ECTC-ineligible households. In our ‘difference-in-differences’ analyses, ECTC eligibility was associated with a 1.9 percentage-point increase in overall food security. This positive effect was particularly strong among low-income households, which saw a 6.3 percentage-point increase.

Figure 1a: Percent change in the probability of excellent or very good health following disbursement of ECTC payments

Figure 1b: Percent change in the probability of food security following disbursement of ECTC payments

Unrestricted Cash Transfer Programs Can Improve Population Health

The ECTC temporarily increased the generosity of the Child Tax Credit benefit to more closely reflect that of other developed countries. It represents the US government’s largest recent attempt at an unconditional cash-transfer program for families with children. In our analysis of nationally representative survey data, ECTC eligibility was associated with improved adult health and household food security. In the latter case, the association was particularly strong for low-income households. The positive relationship between ECTC-eligibility and adult overall health was likely mediated through associated reductions in poverty and financial hardship. Similarly, our findings provide additional evidence of the positive association between income and food security.[9]

Our results suggest that unrestricted monthly cash transfer programs like the ECTC are not only effective anti-poverty measures but may also be powerful population health tools. As future anti-poverty measures are being designed, programs like the ECTC should be considered as a potentially effective method to improve population health.

Jordan M. Rook and Cecile L. Yama are fellows in the National Clinician Scholars Program at UCLA. Adam B. Schickedanz is an assistant professor of pediatrics at UCLA. Alec M. Feuerbach is a resident physician at Kings County Hospital/SUNY Downstate University Hospital. Steven L. Lee is Chief of the Division of Pediatric General and Thoracic Surgery at Seattle Children’s Hospital and the University of Washington Department of Surgery. Lauren E. Wisk is an assistant professor in the Division of General Internal Medicine & Health Services Research at UCLA.

References

1. Chetty R, Stepner M, Abraham S, et al. 2016. The Association Between Income and Life Expectancy in the United States, 2001-2014. JAMA. 315(16):1750-1766. doi:10.1001/jama.2016.4226

2. Milligan K, Stabile M. 2011. Do Child Tax Benefits Affect the Well-Being of Children? Evidence from Canadian Child Benefit Expansions. Am Econ J Econ Policy. 3(3):175-205. doi:10.1257/pol.3.3.175

3. Organization for Economic Co-Operation and Development. Social protection – Family benefits public spending – OECD Data. OECD. Accessed December 9, 2022. http://data.oecd.org/socialexp/family-benefits-public-spending.htm

4. Internal Revenue Service. Child Tax Credit. Published August 25, 2022. Accessed November 19, 2022. https://www.irs.gov/credits-deductions/individuals/child-tax-credit

5. Yarmuth JA. H.R.1319 – 117th Congress (2021-2022): American Rescue Plan Act of 2021. Published March 11, 2021. Accessed July 18, 2022. http://www.congress.gov/

6. Creamer J, Shrider E, Burns K, Chen F. Poverty in the United States: 2021. United States Census Bureau. Published September 13, 2022. Accessed October 31, 2022. https://www.census.gov/library/publications/2022/demo/p60-277.html

7. Internal Revenue Service. Tax Year 2021/Filing Season 2022 Child Tax Credit Frequently Asked Questions — Topic A: 2021 Child Tax Credit Basics. Published April 29, 2022. Accessed December 6, 2022. https://www.irs.gov/credits-deductions/tax-year-2021-filing-season-2022-child-tax-credit-frequently-asked-questions-topic-a-2021-child-tax-credit-basics

8. Rook JM, Yama CL, Schickedanz AB, Feuerbach AM, Lee SL, Wisk LE. 2023. Changes in Self-Reported Adult Health and Household Food Security With the 2021 Expanded Child Tax Credit Monthly Payments. JAMA Health Forum. 4(6):e231672. doi:10.1001/jamahealthforum.2023.1672

9. Drewnowski A. 2022. Food insecurity has economic root causes. Nat Food. 3(8):555-556. doi:10.1038/s43016-022-00577-w